Why Day Trading Is Risky But Still Draws in New Investors

The Fast Lane of Finance: Why Day Trading Remains Risky but Alluring

Day trading risks are often discussed, but rarely understood in full. For many new investors, especially in fast-growing markets like Vietnam, the appeal is undeniable. A chance to grow money quickly, work independently, and make market moves from a smartphone. At the same time, the data shows a different story — most retail day traders lose money. So why do so many still try it?

What Day Trading Actually Is

Day trading refers to the practice of buying and selling financial instruments within the same trading day. Traders look to capitalize on short-term price movements, closing their positions before the market ends. It’s a style defined by speed, precision, and risk — very different from long-term investing strategies.

Often seen as a shortcut to quick returns, day trading has gained popularity among young investors in Vietnam. Thanks to digital trading apps and online brokerages, access to the market has never been easier. But with that access comes exposure to a world that demands more than just interest — it demands experience, capital, and emotional control.

What Makes Day Trading Attractive Despite Its Risks

The appeal lies largely in the promise of fast gains. In a single day, the right call on a stock or index can generate impressive profits. For newcomers with limited capital, this possibility — even if unlikely — can feel like an opportunity worth chasing.

Technology has also played a role in making day trading more approachable. The rise of mobile trading platforms, real-time data tools, and social investing communities has reshaped how people interact with the market. Social media adds fuel to the fire, often presenting stories of young traders who turned modest investments into sizable returns.

In Vietnam, many young investors view day trading not just as a financial tool but as a modern form of entrepreneurship. It allows for flexibility, self-direction, and the excitement of active market participation. It’s no surprise that, despite its challenges, the number of retail trading accounts in the country continues to climb.

Understanding the Core Day Trading Risks

Credit from The Knowledge Academy

Still, beneath the surface lies a complex reality. The risks associated with day trading are serious, and they compound quickly for beginners.

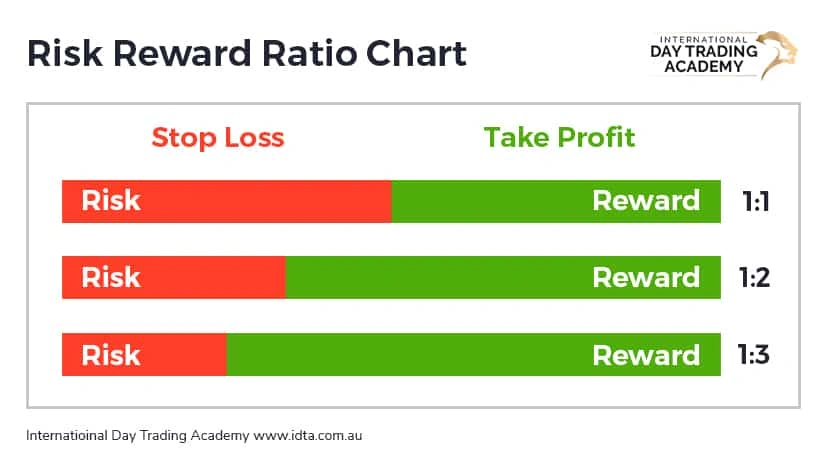

First, the financial risk. Most day traders use margin accounts, which allow them to borrow money to increase their position size. While this can amplify gains, it also multiplies losses. In some cases, traders end up losing more than their original capital. For beginners who lack a disciplined risk management approach, a few bad trades can wipe out months of savings.

Then there’s the emotional toll. Day trading requires rapid decisions, often under pressure. Every trade can feel personal. Anxiety, overconfidence, fear of missing out — these emotions can drive impulsive moves that have little to do with strategy and everything to do with stress.

Finally, there’s the competitive environment. Day traders are not just playing against the market — they are competing with professional firms using high-frequency trading algorithms. These firms operate with better data, faster execution, and years of experience. Retail traders, no matter how determined, are rarely on equal footing.

The Rise of Day Trading in Vietnam

Vietnam’s stock market has experienced a noticeable surge in retail investor activity. Online forums, influencer content, and peer conversations have all helped normalize the idea of day trading as a viable money-making path.

In many ways, this is a reflection of broader economic shifts — a younger population eager to find new income streams and engage with the global financial system. Yet it also raises concerns. Many first-time traders in Vietnam enter the market with limited formal education on risk, leverage, or trading discipline. Some confuse day trading with investing, expecting consistent returns rather than understanding the speculative nature of short-term trades.

There’s also the issue of regulatory gaps. While certain restrictions — such as the Pattern Day Trader rule in the United States — aim to protect retail investors, similar frameworks are still evolving in emerging markets. This leaves many traders vulnerable to excessive risk exposure.

Can Beginners Succeed at Day Trading?

It’s possible, but rare. Studies across multiple markets show that only a small percentage of day traders consistently turn a profit. Most either break even or lose money over time.

Success, when it happens, typically follows months or years of study, practice, and emotional discipline. New traders often start with simulated trading accounts, build a structured strategy, and treat their trading like a business — with defined goals, risk parameters, and performance reviews.

In Vietnam, where financial education is becoming more accessible but still uneven, beginner traders would benefit from starting small. Rather than viewing day trading as a quick solution, it’s better understood as a demanding skill that requires serious preparation.

The Bigger Picture: Trading Versus Investing

Credit from Futures Trading course

It’s important to distinguish between trading and investing. Day trading is short-term, speculative, and time-intensive. Investing, on the other hand, involves holding positions for longer periods — allowing for compound growth, lower transaction costs, and less emotional involvement.

While the two strategies can coexist, they serve different purposes. For new investors, especially those managing limited capital or a busy lifestyle, traditional investing may offer more stability and fewer surprises. And for those who still wish to explore day trading, it should be done with caution, clarity, and a clear understanding of the risks involved.

Conclusion on Day Trading Risks

Day trading risks are easy to overlook when headlines focus on success stories. But behind each viral post is a quieter majority of traders facing steep learning curves and difficult losses. And yet, the appeal remains strong — particularly in dynamic, youthful markets like Vietnam, where financial ambition runs high.

Whether motivated by the thrill of fast gains or the dream of financial independence, every new trader should pause and understand the true nature of the game. Day trading is not inherently bad — but it is not easy, and it is rarely forgiving.

For those considering the path, education is the best starting point. Practice, discipline, and a clear view of the risks can turn a risky habit into a structured pursuit. But even then, success is far from guaranteed. Sometimes, the best trade is knowing when not to enter the market at all.